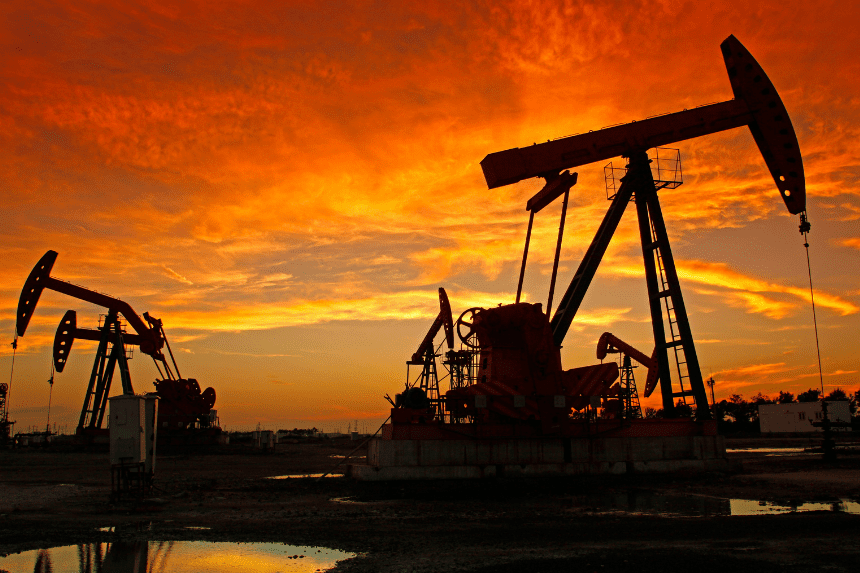

After Israel’s direct military strike on Iran, global oil markets have entered a phase of increased awareness. This development has stoked worries about a Middle East oil supply interruption, a situation with major knock-on repercussions for the world’s economy. Oil dealers, governments, and businesses are especially keenly observing for indicators of escalation as tensions rise. The Middle East is still the most energy-rich area in the world; any unrest here might compromise world supply lines, fuel price stability, and economic forecasts.

- Why is the market for oil responding so quickly?

- Might the Strait of Hormuz have an impact?

- In what ways might this affect the world economy?

- What should consumers and businesses do right now?

- Strategic Reactions of Energy Markets

- How likely is additional escalation?

- Does optimism have any place in this?

- In summary

Why is the market for oil responding so quickly?

Oil prices skyrocketed right after word of the Israeli attack leaked. The two most monitored world benchmarks, Brent Crude and Nymex Light Sweet, rose by more than 10%. Fear, conjecture, and hope for possible Iranian reprisal drove this quick movement. Historically, the geopolitical relevance of the area causes energy markets to react almost immediately whenever conflicts develop in the area.

Price volatility in the Middle East does not depend on a protracted disturbance of the oil supply. Short-term fluctuations in supply projections can also lead to panic purchasing, speculative trading, and abrupt price changes across commodities, including food and petrol.

Might the Strait of Hormuz have an impact?

The possible disturbance in the Strait of Hormuz is among the most urgent issues. Considered the most important oil chokepoint in the world, this narrow canal runs between Iran and the Arabian Peninsula. Every day, over twenty percent of the world’s oil comes through it.

Tankers heading to markets in Asia, Europe, and beyond negotiate this path from major oil suppliers, including Saudi Arabia, the UAE, Iraq, and Qatar. There are hundreds of ships crossing the strait right now. Any attack, threat, or closure would greatly magnify a disturbance of Middle East oil supplies.

Iran has vowed before to block the strait in reaction to military action or sanctions. Given the present escalation, the risk has once more taken front stage in global energy issues. Targeting this region with a militaristic reaction would probably cause a sharp and protracted rise in oil prices. Read another article on the North Sea Ship Collision

In what ways might this affect the world economy?

Variations in oil prices have effects much beyond what is seen at the pump. Rising crude oil prices drive transportation and manufacturing expenses, hence fueling inflation in several spheres. Particularly impacted would be sectors like shipping, logistics, aviation, and agriculture that rely so much on gasoline.

A continuous disturbance of Middle East oil supplies could aggravate inflationary pressures in already delicate countries. It might cause stricter fiscal policies, more interest rate increases, and reduced consumer spending. Now, reevaluating risk models to fit this most recent change are central banks and financial institutions all over.

Furthermore, emerging economies with heavy energy use could suffer more than developed countries. Their currencies may weaken, trade deficits could deepen, and general development may slow down dramatically.

What should consumers and businesses do right now?

Businesses and consumers have to get ready for extended instability, considering the hazards the growing war presents. Particularly those in manufacturing, transportation, and distribution, businesses should review their energy contracts and supply chains. Either tying in long-term contracts or stockpiling basics would help to somewhat offset additional price increases.

Customers should also be aware of the indirect consequences of a disturbance of the Middle East oil supply. Although the most immediate issue is probably fuel, price rises in food, consumer goods, and services will probably follow. Even on a minor level, energy efficiency and cost-saving strategies can help to lessen the effects on household budgets.

Strategic Reactions of Energy Markets

Global energy markets are looking at different backup plans in response to the developing issue. Strategic petroleum reserve countries might start releasing oil to help balance supply. Aiming to avert panic and level out the spikes, organizations like OPEC could hold emergency meetings to evaluate output caps.

Energy dealers, meanwhile, are turning their attention from profit-making to risk control. Futures and options contracts are among the hedging techniques under change to reflect the increasing unpredictability. This change reveals a longer-term worry on the continuation of this crisis and its possible repercussions. Read another article on UK Disrupts Russian Oil Exports

How likely is additional escalation?

Although diplomatic back channels are probably helping to control the aftermath, it is impossible to completely rule out more military engagement. Should Iran respond in a fashion that influences regional infrastructure or shipping routes, the crisis could swiftly get more severe.

Previous conflicts between Israel and Iran were noted by experts as either confined or fleeting. But the stakes are higher this time as both sides have sharpened their rhetoric and actions. Apart from aggravating the Middle East oil supply disturbance, a protracted or enlarged conflict could attract other nations, therefore posing a risk of a more general geopolitical crisis.

Does optimism have any place in this?

Though there is great volatility right now, there is still cautious hope that diplomacy might stop a more general war. Historically, driven by mutual desire in avoiding long-term economic damage, even dramatic flare-ups in the Middle East have been followed by very quiet times.

Stabilizing the area benefits international stakeholders, including the United States, the EU, and Gulf states, therefore influencing their vested interests. Should communication be successful, supply networks might heal, and oil prices might stabilize. Even under the best-case scenario, though, the world has been reminded sharply of how precarious energy security is.

In summary

The latest military escalation between Israel and Iran has set off instantaneous market reactions, mainly in the worldwide oil industry. A possible Middle East oil supply disturbance seriously jeopardizes energy security and economic stability all around. Minimizing the impact will depend mostly on proactive actions, as countries, companies, and people are ready for ongoing volatility.

Whether via diplomatic initiatives, energy diversification, or strategic planning, the next actions made worldwide will define the depth and length of this crisis. The scenario is changing, hence keeping updated is more important than ever.