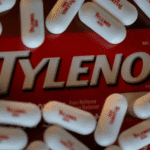

Former U.S. President Donald Trump has unveiled a new round of Trump tariffs, sharply escalating trade measures aimed at protecting American manufacturers. The latest policy includes a 100% tariff on branded or patented drug imports starting October 1, unless companies establish manufacturing operations within the United States.

In addition, Trump announced a 25% import tax on all heavy-duty trucks and a 50% levy on kitchen and bathroom cabinets. He argued the move was necessary to curb the “flooding” of foreign products into the U.S. market, which he says harms domestic producers.

These new tariffs build on an aggressive trade agenda that has already affected over 90 countries, reflecting Trump’s continued push to prioritize American production, employment, and economic independence.

What Industries Are Affected by the New Tariffs?

The Trump tariffs target key sectors pharmaceuticals, trucks, and furniture. Branded drug imports face a 100% tax unless produced in the U.S., affecting exporters like the UK and Germany. Heavy-duty trucks will be hit with a 25% duty to protect domestic makers like Mack and Peterbilt. Furniture, including cabinets and upholstered items, will face tariffs up to 50% to counter import surges that hurt U.S. manufacturers. Here is the link to our article on the Nike Tariff Impact.

How Are Businesses and Trade Partners Responding?

U.S. businesses and trade organizations have voiced serious concerns over the economic implications of these new policies. The U.S. Chamber of Commerce, for instance, has argued that many critical components, especially for truck manufacturing, are sourced from trusted allies like Mexico, Canada, Germany, and Finland.

Mexico and Canada alone account for over 50% of medium and heavy-duty truck part imports into the United States. The Chamber stated that expecting full domestic sourcing is “impractical” and could lead to higher production costs, supply chain delays, and ultimately, increased prices for American consumers.

Despite these concerns, the administration insists that the long-term benefits, such as job creation and reduced reliance on foreign supply chains, justify the trade-offs.

Are These Tariffs Different from Previous Ones?

Yes, the new Trump tariffs differ significantly in structure and scope from previous rounds. Earlier tariffs were generally reciprocal and focused on correcting trade imbalances. These new measures, however, are industry-specific and set at much higher rates.

Trade analysts suggest these tariffs could serve as a strategic fallback amid ongoing legal challenges to Trump’s broader global trade policies. According to experts, the latest measures allow the administration to maintain pressure on international trade partners while ensuring domestic revenue remains stable. Here is the link to our article on the Tariff Court Challenge.

Will Consumers See Price Increases?

Yes, consumers may feel the impact. Trade experts warn that the high import taxes will likely raise retail prices on affected goods. From medications and home furnishings to vehicles and truck parts, the cost burden could shift from importers to end users.

Economists argue that while tariffs may boost certain U.S. industries in the short term, they often lead to inflationary effects. Supply chain disruptions and reduced market competition can drive prices up, especially in sectors with limited domestic production capacity.

Final Thoughts

The latest Trump tariffs reflect a deepening of America’s protectionist stance in global trade. While the policies aim to support domestic industries and reduce dependence on imports, they come with significant risks, including higher consumer costs, strained international relations, and potential legal pushback. As these measures take effect, their real-world impact on the economy, jobs, and American households will become clearer in the months ahead.