The most recent economic data show that US producer prices are rising at the quickest rate in more than three years, which means that inflation is on the rise. The Labor Department said that the Producer Price Index (PPI) rose 0.9% from June to July, which is the biggest month-to-month rise since June 2022. Analysts had predicted a much smaller growth of 0.2%; thus, the announcement came as a shock to both financial markets and politicians.

People are already worried that consumer prices will soon follow this big jump in wholesale costs. Economists say that the combination of higher service sector expenses, higher food prices, and higher import costs due to tariffs is having a negative effect on the economy as a whole.

Why are US producer prices going up so much right now?

The steep rise in taxes on goods coming into the US is a big reason why producer costs are going up. Since these restrictions were put in place, the average effective tariff rate has gone up a lot, affecting everything from raw materials to finished goods.

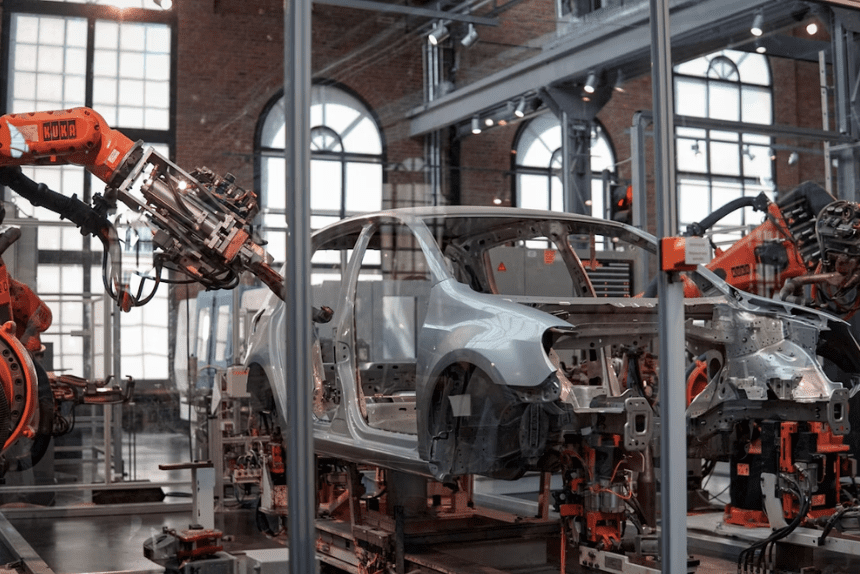

Officials say that tariffs will help American manufacturing by making imported items less competitive, which will make corporations want to buy and make things in the US. Supporters also say that more money for the government is a good thing.

But a lot of economists say that increasing US production is not a quick fix. It takes time and a lot of money to build new facilities, hire qualified workers, and change supply chains. In the near term, these tariffs have made things more expensive for firms, and those costs are now being transferred throughout the supply chain. As a result, the rise in US producer prices is due to a combination of changes in trade policy and changes in the market.

What effect does inflation have on interest rate policy?

Even though the White House has asked the Federal Reserve to lower interest rates to boost the economy, the Fed has held rates the same this year. Central bankers are still being careful because they are afraid that decreasing rates while US producer prices are rising will make inflation go up much faster.

Recent changes in the job market have made things more challenging. Job growth has been slower than projected, and earlier data on consumer prices showed that inflation was staying the same. This has made it more likely that the Fed will think about lowering interest rates.

Scott Bessent, the Treasury Secretary, recently asked for a half-point cut at the September meeting, saying it may help the economy get back on track. Still, the most recent PPI statistics make it seem like the Fed might not want to move. Higher wholesale prices lead to higher consumer prices, which makes it tougher for policymakers to explain why they should cut borrowing costs without risking more price increases.

Which sectors are hit the worst by the surge?

The PPI data reveal that the prices of both goods and services are going up. From June to July, the prices of wholesale services, which include things like warehousing and investment advice, went up by 1.1%. This was one of the biggest increases in recent years. Prices for goods went up 0.7% during the same time, with almost half of that rise coming from rising food prices.

Some groups that are especially vulnerable to tariffs witnessed considerably bigger jumps. Home furniture, clothing, and other consumer goods that rely heavily on imports have had to deal with rising costs. This shows how trade policy choices made in Washington may have immediate, measurable effects on things that Americans use every day.

The wide range of these price rises shows why the rise in US producer pricing isn’t just happening in one industry. Instead, it’s a trend that affects merchants, manufacturers, and service providers all across the world. Read another article on the US Election Economic Impact

What effects are expected to happen to consumers?

The US producer prices spike suggests that wholesale prices will likely go up shortly, which would mean higher prices for consumers as well. Companies that are seeing their costs go up have to choose whether to eat those costs, lower their profit margins, or pass them on to customers.

A lot of businesses are already saying that prices are going to change soon. For instance, grocery stores might raise the costs of goods to cover the expense of shipping in fruits and vegetables or packaging materials. Furniture stores might hike costs because tariffs make parts from other countries more expensive.

If these price rises stay around for a long time, people might notice that prices are going up on daily things like clothes and household goods. This would hurt both buying power and consumer confidence, which is very important for economic growth.

What can companies do about the surge?

The rise in US producer prices is a problem, but businesses may do things to lessen its effects. One way to avoid relying too much on imports that are subject to high tariffs is to source from a variety of countries. Another way to deal with price changes is to arrange contracts with suppliers that lock in costs.

Companies can also make their operations more efficient by eliminating superfluous steps and costs. In some circumstances, adding products that add value and have larger profit margins might help cover rising costs. These changes need some planning, but they can help people be more resilient when prices are unstable.

What will happen next with the economy?

There are a number of things that will affect the path of the US producer prices spike in the future. These include future trade talks, changes in what people want to buy, and how the Federal Reserve handles interest rates. If tariffs are in place and global supply chains keep having problems, wholesale prices could stay high.

But some of these pressures might go down if trade tensions relax or the ability to make things at home gets better. Analysts will be keeping a careful eye on incoming inflation data to see if the July jump is just a short-term blip or the start of a longer-term trend.

The message is obvious for now: prices are going up at the wholesale level, and both enterprises and consumers should get ready for the likelihood of greater costs shortly.

Last Word

The rise in US producer prices is more than just a number; it’s a symptom of bigger changes in the economy that are connected to trade policy, global supply chains, and monetary policy. Companies that change their operations early will be better able to handle the storm, and consumers who stay up to date can make wiser financial decisions in a changing environment.